Is the current U.S. fiat economy sustainable? Debt backed by debt backed by debt......

#22

Posted 2006-May-31, 08:34

Quote

I imagine it's a bit of both, but we can just look it up. Looking at the data, the average world price for crude oil has gone from $45.20/barrel to $66.94/barrel in the past year (May to May). The price increase in the US is pretty similar ($43.36 to $65.54). So oil prices in general are at a relative high. (Source: Department of Energy, see website below) And comparing them to a year ago, the price of crude oil is about 50% higher than it was last year. (which is enough to explain your paying 50% more at the pump)

http://tonto.eia.doe...pri_wco_k_w.htm

What about the value of the dollar? In the same period as above (May to May), 1 Euro has gone from $1.25 to $1.28. 1 British Pound has gone from $1.82 to $1.87. And 100 Yen has gone from $0.93 to $0.89. (Source: Oanda historical currency exchange rates) So it seems as though the price of the dollar falling is not the source of price increase.

http://www.oanda.com/convert/fxhistory

Quote

I agree that the US dollar is fiat money. I don't agree with the rest of the sentiment. Frances mentioned in her post that gold is a volatile commodity in terms of prices. So why should we peg our currency to the price of gold? To give you an example, over the same period gold has gone from 335Euro/oz to 512 Euro/oz. A much bigger change. So saying that the value 'did not change drastically' is incorrect.

Quote

Sure there is. Just use the method I suggest above by looking at prices for oil around the world.

Quote

I don't disagree with the argument, I just find it to be untrue.

Quote

The value of the dollar is in fact determined by the value of all US goods and services. Pegging it to one commodity such as gold seems silly in my opinion. I know others might disagree.

Quote

I can't claim something will be sustainable indefinitely, but I don't see what is inherently unstable about the system. All major economies use fiat money, so it seems that common wisdom suggests it is the best way. I'm certainly not one to disagree.

#23

Posted 2006-May-31, 08:42

DrTodd13, on May 29 2006, 05:03 PM, said:

In my opinion this is pure paranoia. I do agree that governments can utilise inflation to lower their own real debt by printing more money. The term for this is seignorage and has been used in the past in countries where there are large black market operations. The reasoning is that inflation is a "tax" that no one can avoid. However, given that inflation in the US and Western Europe is pretty low, I don't see what the complaint is!

However, instead of arguing this, let me phrase it another way. There is a legitimate discussion of "zero inflation targeting". But I'm not sure if this is what you are arguing for. I will leave that discussion to the macroeconomists.

#24

Posted 2006-May-31, 17:19

some may feel that the war in iraq is immoral... imagine if the usa had to finance that war with real money (money based on something of value)... i think it would have been less likely that an attack would have occurred... notice that during wwI and wwII the usa, britain, and others had to first come off the gold standard...

#25

Posted 2006-May-31, 19:22

Polls show that people want more spending (when you ask program by program, which is how the budget is built), AND lower taxes. Election results bear this out.

Printing money is democracy in action.

Peter

#26

Posted 2006-May-31, 19:45

that's the new orleans area, it's (mostly) different in other parts of the state (where rita hit, for example) and it coastal mississippi... i have a son who is a policeman in diamond head, ms and a daughter who lived in waveland, ms... both lost everything... neither has simply sat and waited for someone else to clean up and rebuild

for anyone interested, here's a link to a story that was done on shane, ivy, and the kids... my other two sons had comments below the story, and ivy had a few things to say to some posters <go girl> ... they are saving money and are doing better... i never replied to any of those negative posts, as much as i wanted to.. my replies were of a different nature... but a dad could not be more proud of a son... army ranger, trained others at hood, fought in iraq, was home maybe 3 monts and then katrina... he has a great wife and wonderful kids (i don't say that just cuz i'm paw paw

http://risingfromrui...ife_in_a_f.html

This post has been edited by luke warm: 2006-June-02, 11:59

#27

Posted 2017-August-16, 15:53

Winstonm, on 2006-May-27, 12:32, said:

Winstonm, on 2006-May-27, 12:32, said:

The U.S. dollar is fiat money, paper money with no inherent value other than as a trading medium. Let us suppose for a moment that the U.S. dollar were backed by a standard such as gold, that is one U.S. dollar could be redeemed for one gold coin. In such a case, when I had to pay an extra dollar for my gasoline I would know that the scarcity or demand for gasoline had risen - supply and demand at work to establish prices. I would know this because the value of gold did not change drastically - my dollar bill would still "buy" one gold coin.

However, when I am using fiat money, there is no way to determine whether the demand/scarcity of gasoline has changed or whether the value of the I.O.U. "dollar" I am using as an exchange medium has changed.

Suppose I am OPEC with one barrel of oil to sell. Last year I could sell the U.S. that barrel for fifty U.S. dollars and turn around and use those fifity U.S. dollars to buy a vcr from Japan; however, this year, the Japan vcr makers want seventy U.S. dollars for the same vcr - not because of demand/scarcity of vcrs, but because on the world market the trust of the value of the U.S. dollar has declined. So as OPEC, I simply raise my price to accomodate the decline in the dollar. So this year I charge seventy U.S. dollars for that barrel of oil.

This free-floating market value of the dollar could not occur with a commodity-backed currency. The value of the currency is determined by the value of the commodity.

So my question is this: can a fiat economy be sustained indefinately or is there a point at which it must collapse?

Excellent observations.

I have to resurrect this question because the petrodollar can be sustained as long as the entire world needs to pay OPEC for their oil in U.S. dollars--the instance that a country starts to get the funny idea that they can pay OPEC for oil in a functional currency different than the U.S. dollar then our monetary hegemony is at risk and we must use our military to respond to such insubordination.

Quote

https://en.wikipedia...s_energy_crisis

Quote

Many factors have resulted in possible and/or actual concerns about reduced supply of oil. The post-9/11 war on terror, labor strikes, hurricane threats to oil platforms, fires and terrorist threats at refineries, and other short-lived problems are not solely responsible for the higher prices. Such problems do push prices higher temporarily, but have not historically been fundamental to long-term price increases.

Investment/speculation demand

Investment demand for oil occurs when investors purchase futures contracts to buy a commodity at a set price for future delivery. "Speculators are not buying any actual crude. ... When [the] contracts mature, they either settle them with a cash payment or sell them on to genuine consumers. Several claims have been made implicating financial speculation as a major cause of the price increases in the 2000's."

#28

Posted 2017-August-16, 20:12

Otoh, people drive more. A lot more. When my father traded in his 1940 Chevrolet for a new 1953 Chevrolet the old one had about 70K miles on it, as I recall. And it was our only car.

Besides whatever bit of nostalgia interest this holds, to me it indicates, once again, that we have to be very careful in looking at statistics. It's not that the data is (oh, excuse me, are) faked or in any way wrong, but unless we look at all aspects of it, we can come to misleading conclusions.

#29

Posted 2017-August-16, 22:20

Since we don't understand what aspects mean we don't fully understand the conclusion of statistics.

Just to start the discussion people don't understand error or +- error....when discussing poll results. If math guys can get the public to just understand this much, granted many concepts involved, not just one......you advance the discussion.

If you want to discuss misunderstand basic beginner terms perhaps the most basic misunderstood term is standard deviation. People, students just find this a very difficult concept.

Ken hopefully you of all posters besides say Richard or Helena hopefully understand if the public don't uderstand SD the public don't get the rest.....

#30

Posted 2017-August-17, 05:30

kenberg, on 2017-August-16, 20:12, said:

kenberg, on 2017-August-16, 20:12, said:

Otoh, people drive more. A lot more. When my father traded in his 1940 Chevrolet for a new 1953 Chevrolet the old one had about 70K miles on it, as I recall. And it was our only car.

Besides whatever bit of nostalgia interest this holds, to me it indicates, once again, that we have to be very careful in looking at statistics. It's not that the data is (oh, excuse me, are) faked or in any way wrong, but unless we look at all aspects of it, we can come to misleading conclusions.

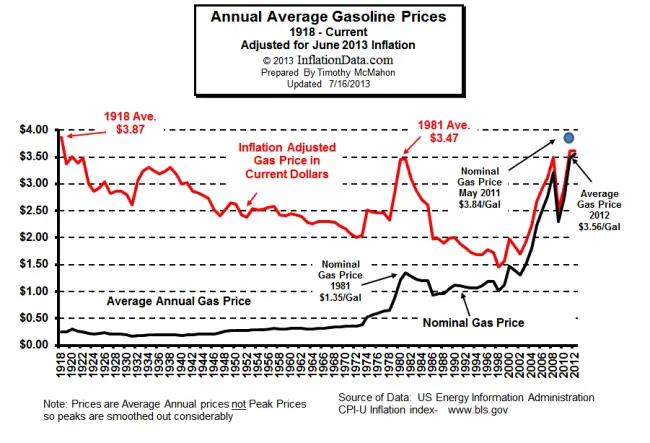

You bring up a very important point. We consumers have to remember the importance of "messaging" the retail data we see at the pump. Inflation is a silent tax we pay at the gas pump and we have to adjust the nominal price we pay at the pump for inflation to see the TRUE price of gas. I think people are still curious as to what was going on between 2000-2013 even after adjustments to try to better understand our commodities market.

However, as you have astutely observed, we are putting way more miles on our cars because we are driving a whole lot more in 2017 than we were in 1950. So the total cost of gas in our budget now is proportionally higher than in the past.

Question: So are the extra miles we put on our cars a function of our trying to fit more side trips in a given day in this frenetic paced society? Or is it a function of our state and federal governments not finding other transportation infrastructure alternatives to our car problem than just building more and more roads and/or repairing our existing federal highway system? Or is it a function of something else?

#31

Posted 2017-August-17, 06:09

Is the Constitutional power that Congress has to coin money assignable to the Federal Reserve Bank cartel system?

#32

Posted 2017-August-17, 08:46

RedSpawn, on 2017-August-17, 05:30, said:

RedSpawn, on 2017-August-17, 05:30, said:

But fuel efficiency has also improved, so you can drive farther on the same amount of gas. MPG of passenger cars has improved 40% since 1980.

#33

Posted 2017-August-17, 10:00

RedSpawn, on 2017-August-17, 05:30, said:

RedSpawn, on 2017-August-17, 05:30, said:

It is a cliche that we of an age can be at least bemused by the many ways in which the world has changed. Mobility is certainly an example. I boarded a plane for the first time when I was a grad student going to a math conference.

One of the pleasures of aging is that I now pay people to do things that I don't want to bother with. The dashboard on my car lit up to tell me that it needed some routine maintenance, so I took it in. An oil change. Ok. Time to change the transmission fluid. Ok. It also needed a coolant liquid flush and exchange. This would be $164. This is like when I opened the valve at the bottom of my radiator, unscrewed the cap at teh top, started the engine running, poked a garden hose into the radiator and turned on the water? Of course adding Prestone for the Minnesota winters? I chuckled and said ok. I treat the car to these perks, it takes me where I want to go. That's a deal.

A good part of the change in driving is that we do it because we can. Actually, this reason can be used to explain a lot of things.

#34

Posted 2017-August-17, 16:58

I suppose hours worked to pay for something might be more realistic if harder to define on an average or median basis.

#35

Posted 2017-August-18, 05:24

Al_U_Card, on 2017-August-17, 16:58, said:

Al_U_Card, on 2017-August-17, 16:58, said:

I suppose hours worked to pay for something might be more realistic if harder to define on an average or median basis.

http://www.bankrate....than-you-think/

Wha? I had to double check your story about gas and food not being included in the core inflation calculation (CPI). Where is the super-like button again?

Man, am I wiping eggs off of my face. The Bureau of Labor Statistics ran a fast one on me. UGH! You learn something new every day. Thanks for that information.

#36

Posted 2017-August-18, 07:03

https://energy.gov/e...price-1929-2015

https://data.bls.gov...07&year2=201707

I mentioned 1954, the year I bought my first car.

The first of these sites informs us that the average price at the pump in 1954 was 29 cents a gallon. This is a little higher than I remember it but maybe it depends on regular versus premium or something like that.

The second site converts 29 cents to today's dollars. I used July 1954 and July 2017, and it converts 29 cents to $2.64. Locally gas is about $2.30 so it seems to be in that the inflation index when applied to gas prices is in right ballpark.

It is fair to ask "Who cares about 1954?". But at the other extreme the Banknote site that

I certainly would agree that gas prices are more important than coffee prices. I have been buying coffee even longer than I have been buying gas, but gas is needed in a way that coffee is not.

I still insist that we need to take great care drawing conclusions from these or any statistics. By 1950 or so I was old enough, 11, so that the local drug store would serve me coffee. But it was drug store coffee. 10 cents for a cup, 5 cents for a refill is what I recall, but that may be off. I think it was a nickel a cup at the White Castle.

Comparing then and now is not simple, or at least I don't think that it is. My father had an 8th grade education, I grew up in a small but nice house, I went to a not great but decent school, the neighborhood was safe at least if you didn't act like an idiot. In short, I look back with pleasure on my early years. I get the idea that life is far less simple for many growing up today. I do understand that being white helped a lot. It still does, no doubt.

I am skeptical of the CPI as being a good explanation of where today's problems lie.

#37

Posted 2017-August-18, 07:04

RedSpawn, on 2017-August-18, 05:24, said:

RedSpawn, on 2017-August-18, 05:24, said:

Wha? I had to double check your story about gas and food not being included in the core inflation calculation (CPI). Where is the super-like button again?

Man, am I wiping eggs off of my face. The Bureau of Labor Statistics ran a fast one on me. UGH! You learn something new every day. Thanks for that information.

There is John Williams ( Shadowstats ) who has been "keeping track" of the original lists, to show "real" inflation rates. This is why our income doesn't seem to buy as much as it used to....

#38

Posted 2017-August-18, 07:09

#40

Posted 2017-August-19, 06:31

Help

Help